Secure Remote Work, Compliance & Fraud Prevention for Teams

In brokerage and mortgage firms, remote agents handle high-value transactions, sensitive client data, and regulatory-heavy workflows. RemoteDesk ensures real-time monitoring, biometric facial authentication, and airtight session controls—helping you prevent fraud, ensure compliance, and safeguard trust throughout every digital interaction.

The fastest-growing companies use RemoteDesk.

Challenges

RemoteDesk Capabilities for Mortgage & Brokerage Workflows

Advance Workforce Monitoring

Ensure secure and compliant environments for remote agents, processors, and underwriters.

● Detects screen sharing applications, distraction, or shadow browsing

● Enforces policy compliance with customizable alerts

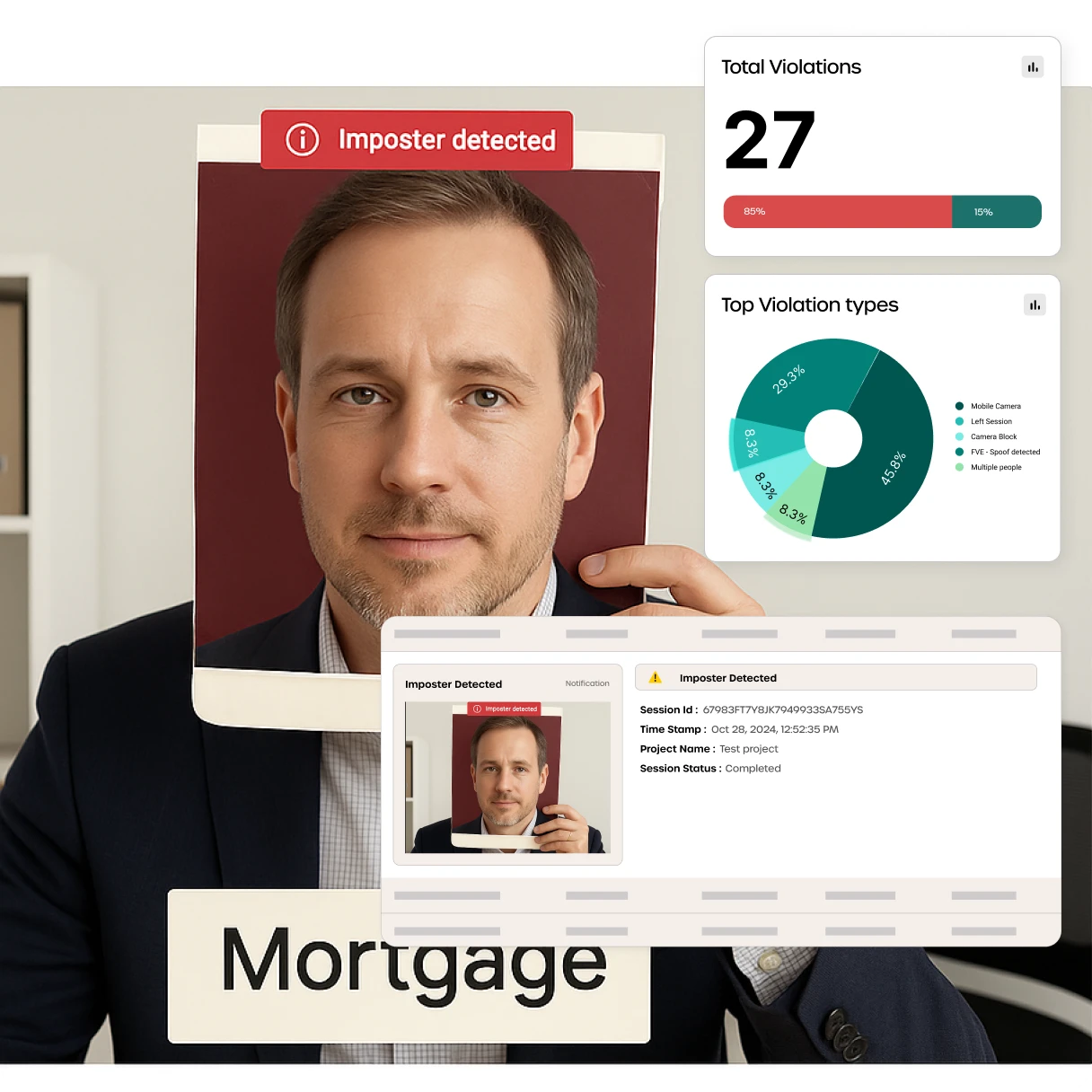

FaceAuth Continuous Verification

FaceAuth confirms that only authorized agents access and manage sensitive workflows.

● Prevents impersonation or session takeover

● Prevents session hijacking or proxy users

● Locks access on facial mismatch or absence

● Maintains accountability during document verification or fund transfers

Data Protection & Leak Prevention

Protect Personally Identifiable Information (PII), loan details, and investment data in real-time.

● Blocks screenshots, and screen recording apps

● Prevents exposure of credit, income, and client portfolio data

Violation Management Dashboard

Capture, categorize, and document all breaches with visual proof.

● Role-based violation tracking (e.g., processors vs. brokers)

● Session-level logs for audit and internal compliance

● Admin dashboard with live alerts and exportable reports

Security Challenges in the Brokerage & Mortgage Sector

RemoteDesk is designed to make your work life easier and more efficient.

$6.2B

Annual global losses from piracy and content leaks.

2 in 3

Mortgage and brokerage firms report growing risks from hybrid work setups.

91%

Regulatory non-compliance fines linked to poor access logging or data exposure.

For Workforce

How RemoteDesk Secures Brokerage & Mortgage Remote Teams

Know More

Frequently asked questions

Everything you need to know about the product and billing.

-

Q1: How does RemoteDesk protect mortgage applications and client documents from leaks?

RemoteDesk blocks screen captures, while monitoring for suspicious user behavior or secondary device usage.

-

Q2: Can it help ensure agents don’t outsource tasks or share credentials?

Yes. Continuous FaceAuth ensures only authorized users remain active throughout sessions—automatically locking access on mismatch or substitution.

-

Q3: Is RemoteDesk compliant with FCRA, GLBA, and mortgage industry standards?

RemoteDesk supports compliance with multiple financial regulations through detailed audit logs, session-level oversight, and customizable security policies.

-

Q4: Can RemoteDesk be tailored for underwriters, brokers, and support teams separately?

Absolutely. You can create different policy sets based on roles, workflows, or regions—ensuring focused monitoring without disrupting productivity.

-

Q5: Does it work with CRM or LOS platforms used in the industry?

Yes. RemoteDesk operates independently of your tools—it overlays monitoring without interfering with systems like Encompass, Calyx, Salesforce, or Blend.

Get Started Today

Sign up in minutes. Secure your remote

workforce with confidence.

See how RemoteDesk makes compliance and data protection effortless.